31+ Illinois Paycheck Calculator 2022

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. All you have to do is enter wage and W-4.

Villas At Crystal Lake Apartments 3735 Round Hill Road Swansea Il Rentcafe

C1 Select Tax Year.

. Our Illinois payroll calculator is designed to help any employer in the Land of Lincoln save time and get payroll done right. The maximum an employee will pay in 2022 is 911400. Total annual income - Income tax liability Payroll tax liability Pre-tax deductions Post-tax deductions.

Net income Payroll tax rate Payroll tax liability Step 6. It can also be used to help fill steps 3 and 4 of a W-4 form. 2022 Federal Tax Withholding Calculator 2022 Federal Tax Withholding Calculator Remember.

Single Head of Household Married Filing Joint Married Filing Separate Qualifying. The Illinois Paycheck Calculator is designed to help you understand your financial situation and determine what you owe in taxes. Heres a step-by-step guide to walk.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. This free easy to use payroll calculator will calculate your take home pay. This is a projection based on information you provide.

Illinois paycheck calculator Payroll Tax Salary Paycheck Calculator Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Estimate Your Federal and Illinois Taxes.

Illinois Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. This calculator is a tool to estimate how. Supports hourly salary income and multiple pay frequencies.

The Illinois Paycheck Calculator uses Illinois tax tables. C2 Select Your Filing Status. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

The following steps allow you to calculate your salary after tax in Illinois after deducting Medicare Social Security Federal Income Tax and Illinois State Income tax.

Illinois Paycheck Calculator 2022 2023

Abstracts 2022 Hepatology Wiley Online Library

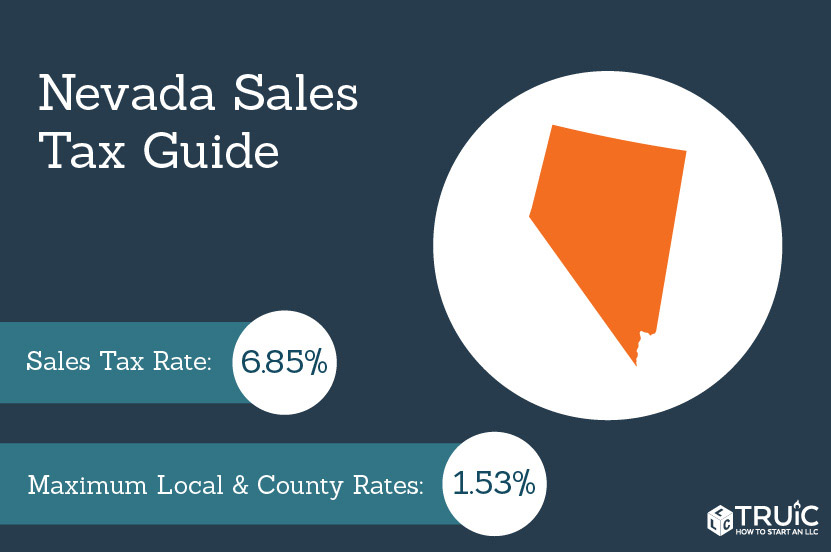

Nevada Sales Tax Small Business Guide Truic

Free Online Paycheck Calculator Calculate Take Home Pay 2023

Federal Register Medicare Program Fy 2016 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements

Illinois Paycheck Calculator 2022 2023

Us Paycheck Calculator Queryaide

Illinois Income Tax Calculator Smartasset

Pdf Critical Security Approach To Climate Change With An Emphasis On Marginalized Global Inequalities Faruk Hadzic Academia Edu

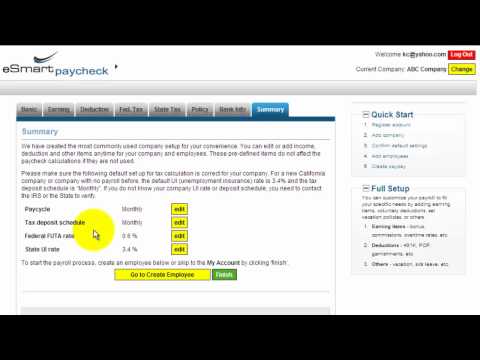

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Free 10 Retirement Income Checklist Samples In Pdf Doc

Illinois Paycheck Calculator Adp

Illinois Paycheck Calculator Smartasset

Illinois Paycheck Calculator Adp

Illinois Hourly Paycheck Calculator Gusto

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023